In today’s data-driven financial world, having access to reliable historical stock data is essential for in-depth market analysis and making informed investment decisions. Python, celebrated for its versatility and powerful data analysis libraries, has become a go-to language for financial data analysis. Among the various tools available, yfinance stands out as a simple yet powerful library that provides an easy-to-use interface for downloading historical market data from Yahoo Finance. This article offers a comprehensive introduction to yfinance, guides you through its setup, and demonstrates how to fetch, analyze, and visualize historical stock data.

Table of Contents

What is yfinance?

yfinance is an open-source Python library designed to simplify the process of downloading financial data. Originally developed to address limitations in Yahoo Finance's official API, yfinance offers a reliable and efficient way to retrieve stock prices, company financials, and other market indicators. Whether you are a seasoned financial analyst or a programming newcomer, yfinance makes complex financial data easily accessible for further analysis using familiar Python tools.

Key features of yfinance include:

- Historical Data Retrieval: Obtain detailed historical stock data including Open, High, Low, Close, Volume, Dividends, and Stock Splits.

- Multiple Ticker Support: Fetch data for one or more stock symbols simultaneously.

- Company Insights: Retrieve additional financial metrics such as earnings, sustainability measures, and balance sheet information.

- Integration with Pandas: Data is returned as a

pandas.DataFrame, allowing you to seamlessly integrate with the powerful data manipulation capabilities of Pandas.

Setting Up yfinance

Before you can start fetching financial data, you need to install the yfinance package. Installation is straightforward using pip:

pip install yfinanceOnce installed, you can import yfinance in your Python script:

import yfinance as yfThis simple step prepares you to begin downloading and analyzing market data.

Fetching Historical Stock Data

One of the core functionalities of yfinance is its ability to download historical stock data. Let’s walk through a basic example of fetching historical data for Apple Inc. (ticker: AAPL).

Example: Fetching Apple Inc. Stock Data

# Import yfinance

import yfinance as yf

# Create a ticker object for Apple Inc.

apple = yf.Ticker('AAPL')

# Fetch historical stock data from January 1, 2020 to January 1, 2023

historical_data = apple.history(start='2020-01-01', end='2023-01-01')

# Display the retrieved data

print(historical_data)In this example, a ticker object is created for Apple Inc. Using the history method, data from January 1, 2020, to January 1, 2023, is downloaded. The resulting DataFrame includes daily Open, High, Low, Close, Volume, and Dividend information, providing a detailed view of the stock’s historical performance.

Sample output:

Open High Low Close Volume Dividends Stock Splits

Date

2020-01-02 00:00:00-05:00 71.799873 72.856613 71.545387 72.796021 135480400 0.0 0.0

2020-01-03 00:00:00-05:00 72.020447 72.851776 71.862907 72.088310 146322800 0.0 0.0

2020-01-06 00:00:00-05:00 71.206092 72.701515 70.954024 72.662735 118387200 0.0 0.0

2020-01-07 00:00:00-05:00 72.672409 72.929322 72.100418 72.320976 108872000 0.0 0.0

2020-01-08 00:00:00-05:00 72.022865 73.787323 72.022865 73.484360 132079200 0.0 0.0

... ... ... ... ... ... ... ...

2022-12-23 00:00:00-05:00 129.557588 131.041978 128.290909 130.487808 63814900 0.0 0.0

2022-12-27 00:00:00-05:00 130.012807 130.042493 127.380484 128.676849 69007800 0.0 0.0

2022-12-28 00:00:00-05:00 128.320592 129.666440 124.560142 124.728371 85438400 0.0 0.0

2022-12-29 00:00:00-05:00 126.658071 129.122157 126.400782 128.261215 75703700 0.0 0.0

2022-12-30 00:00:00-05:00 127.073679 128.597646 126.103875 128.577850 77034200 0.0 0.0

[756 rows x 7 columns]Analyzing and Manipulating the Data with Pandas

Because yfinance returns data in a pandas.DataFrame, you can leverage Pandas’ robust data manipulation tools for further analysis. For instance, calculating a moving average is a common task in financial analysis.

Example: Calculating a 20-Day Moving Average

# Calculate the 20-day moving average of Apple's closing price

moving_average = historical_data['Close'].rolling(window=20).mean()

# Add the moving average as a new column in the DataFrame

historical_data['20 Day MA'] = moving_average

# Display the updated DataFrame

print(historical_data.tail())In this snippet, a 20-day moving average is computed for Apple’s closing prices using Pandas’ rolling method. This new column can help identify trends and smooth out short-term fluctuations, offering insights into the stock’s longer-term performance.

Visualizing Stock Data

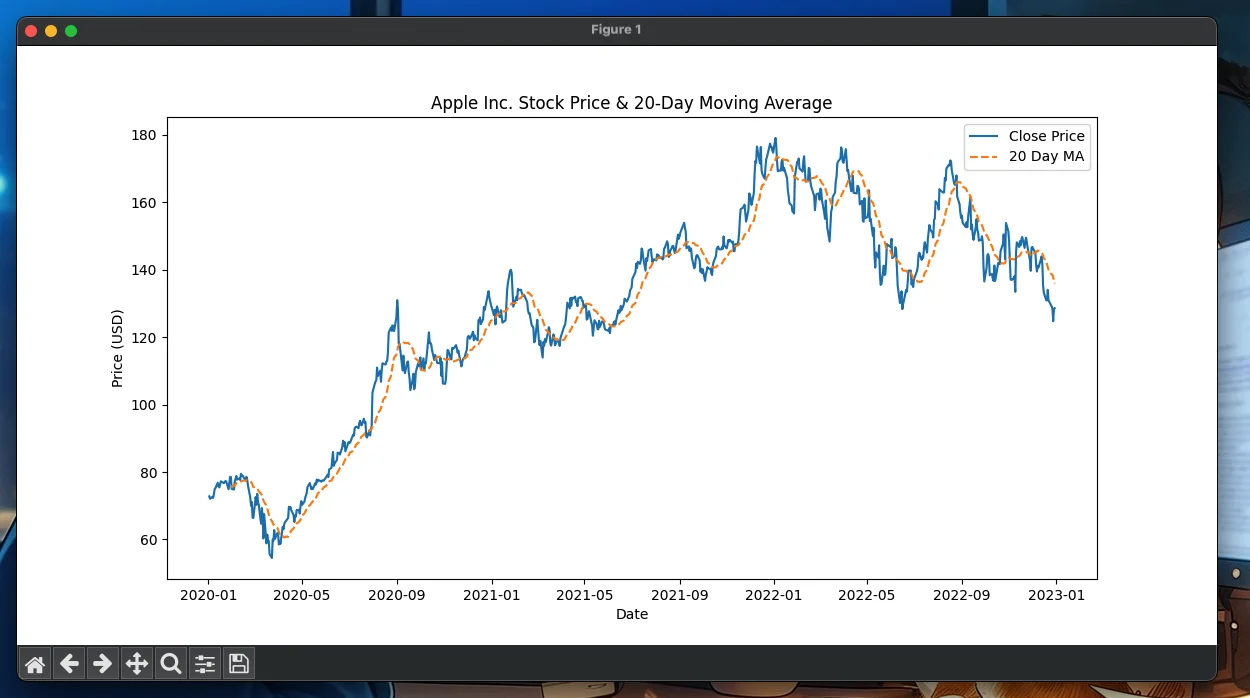

Visual representation of data is key to understanding market trends. You can easily integrate yfinance with visualization libraries like Matplotlib or Seaborn.

Example: Plotting Closing Prices with Moving Average

Install matplotlib:

pip install matplotlibFull code:

import matplotlib.pyplot as plt

# Import yfinance

import yfinance as yf

# Create a ticker object for Apple Inc.

apple = yf.Ticker('AAPL')

# Fetch historical stock data from January 1, 2020 to January 1, 2023

historical_data = apple.history(start='2020-01-01', end='2023-01-01')

# Calculate the 20-day moving average of Apple's closing price

moving_average = historical_data['Close'].rolling(window=20).mean()

# Add the moving average as a new column in the DataFrame

historical_data['20 Day MA'] = moving_average

# Plot the closing prices and the 20-day moving average

plt.figure(figsize=(12, 6))

plt.plot(historical_data.index, historical_data['Close'], label='Close Price')

plt.plot(historical_data.index,

historical_data['20 Day MA'], label='20 Day MA', linestyle='--')

plt.title('Apple Inc. Stock Price & 20-Day Moving Average')

plt.xlabel('Date')

plt.ylabel('Price (USD)')

plt.legend()

plt.show()

This code creates a clear line chart comparing Apple’s closing prices with its 20-day moving average, providing a visual cue to help identify trends and potential buy or sell signals.

Screenshot:

Managing Multiple Tickers

yfinance also supports downloading data for multiple tickers in one go, which is particularly useful for portfolio analysis or comparative studies.

Example: Downloading Data for Multiple Stocks

# Download historical data for Apple, Microsoft, and Google

stocks = yf.download('AAPL MSFT GOOGL', start='2020-01-01', end='2023-01-01')

# Display the first few rows of the multi-index DataFrame

print(stocks.head())In this example, the download method is used to fetch data for Apple (AAPL), Microsoft (MSFT), and Google (GOOGL) over the same historical period. The resulting DataFrame will have a multi-level column index, making it convenient to compare the performance of these stocks side by side.

Advanced Features and Financial Metrics

Beyond historical stock prices, yfinance can retrieve a wide range of financial metrics and company-specific data. This includes details like earnings calendars, balance sheets, and sustainability metrics.

Example: Retrieving Additional Company Information

# Fetch additional company information for Apple

apple_info = apple.info

# Fetch the earnings calendar for Apple

earnings_calendar = apple.calendar

# Display the company information and earnings calendar

print("Company Information:")

print(apple_info)

print("\nEarnings Calendar:")

print(earnings_calendar)This section of the code demonstrates how to access comprehensive information about a company, such as market capitalization, sector details, and upcoming earnings dates. Such information is invaluable when performing due diligence or creating a detailed financial analysis report.

Error Handling and Best Practices

While yfinance is user-friendly, it’s important to incorporate error handling into your code to manage potential issues such as network errors, missing data, or changes in Yahoo Finance's data structure.

Example: Basic Error Handling

try:

# Attempt to fetch historical data

historical_data = apple.history(start='2020-01-01', end='2023-01-01')

except Exception as e:

print("An error occurred while fetching data:", e)Implementing error handling ensures that your application can gracefully manage unexpected issues and provide meaningful feedback to the user.

Integrating yfinance with Your Data Analysis Workflow

yfinance’s seamless integration with Pandas and visualization libraries means it can be a cornerstone in your data analysis workflow. Whether you are:

- Conducting Technical Analysis: Use historical data to calculate indicators such as moving averages, Bollinger Bands, and RSI.

- Performing Quantitative Research: Combine stock data with statistical libraries like NumPy and SciPy for complex analyses.

- Building Financial Models: Leverage the historical and real-time data capabilities of yfinance to create predictive models and backtesting systems.

By incorporating yfinance into your Python projects, you can develop robust financial tools tailored to your analytical needs.

Conclusion

yfinance is an indispensable tool for anyone interested in financial data analysis. Its ease of use, combined with the powerful data manipulation capabilities of Pandas, makes it a valuable resource for fetching historical stock data, analyzing market trends, and integrating financial metrics into your projects. Whether you are a financial professional, a data scientist, or a hobbyist looking to explore the stock market, yfinance provides the building blocks necessary for creating sophisticated and insightful analyses.

By following this guide, you now have a solid foundation to start exploring the capabilities of yfinance. From simple data downloads to advanced financial analytics and visualization, yfinance opens the door to a deeper understanding of the financial markets—all through the power of Python.

Happy coding and insightful investing!